Company

Metrobank is one of the three biggest banks in the Philippines ($55B annual asset base).

Scale and Goals

It employs 12,000 people, has 900 branches, and has been around for over 50 years.

We were invited to bring a human-centered design approach into a conservative, legacy bank.

Role

At first, we were a three-person team of independent consultants.

– We were, then, “acqui-hired”. I started as a Design Strategist (in a principal or individual contributor role).

Eventually, I became Associate Vice President for Product and Service Design.

– Being part of a “lean team” in the bank – I functioned as a UX Researcher, Product Manager, Design Strategist, and team manager.

Collaborators

I primarily worked within the Digital Banking team (with product managers, project managers, testers, and the design team). And, to be effective in my role, we needed to collaborate with leadership and various teams: the IT Department, Operations Department, Branch Banking, Trust Banking, Treasury, Customer Experience, and Controls (Policy and Legal).

Context

Metrobank has a reputation for being the most conservative of the “Big 3” banks in the Philippines. As a traditional commercial bank in an era of digitalization, its leadership wanted to ensure that the business was future-ready.

Inspired by human-centered design-centric Digital Transformation initiatives abroad (ING – Netherlands, DBS – Singapore), leadership sought to apply the same approach to the bank.

The experiment was to bring in some non-bankers to inject innovation as a “skunkworks” team.

Work

I’m a UX researcher, by trade. And, for this opportunity, I was Design hire #1.

Those two facts together are a rare occurrence in the traditional corporate world (a non-visual designer as an early hire for Design), which is why I was deeply impressed about the leader’s commitment to the customer-centered approach.

This job was probably the one that I threw my heart into the most. I pulled out all the stops, as I felt that Filipinos had gotten very used to painful customer service experiences across many institutions.

For this ~5-year mission, I did the following:

- facilitated research: Content testing (this was a personal highlight, because this was my first time doing Cloze testing✨), a longitudinal (pre- and post-pandemic) diary study, contextual inquiries and multiple usability tests at varying “fidelities” of a product

- taught lean research, customer journey mapping, and service blueprinting to both a waterfall multi-discipline team who wasn’t familiar with iterative design, and to bank business unit partners

- created the team’s performance framework

- created the framework for roles in the department

- taught and implemented OKRs

- taught iterative processes: such as the concept of MVP and retrospectives

- made the product roadmap; made the research roadmap

- asked to consult for the Market Research division of the bank

- audited successful digital transformation product roadmaps

- analyzed analytics data, when there was no process for it

- participated in the prioritization “council” for IT projects of the bank

- did a year of being the Head of Product Management: In charge of launching a web app (building users’ saving behavior)

Impact

Based on team feedback I received, I was able to build a more human-centered mindset in the design team, and in adjacent teams.

- The Legal team realized how complicated the investment contracts were, and Operations understood the roles of different touchpoints better.

- We were able to launch an app that objectively increased savings amounts.

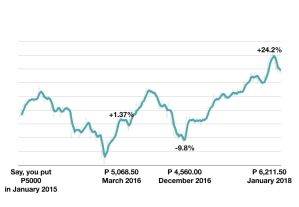

- [It was a bad time to invest, so this was a more minimal “bump” in performance] We were able to make a mobile app that made it easier for UITF (a bank-managed mutual fund) investors to invest –no more going to branches just to do straightforward transactions.

- We piloted a digital operations team, which helped the Digital Banking and Branch Banking teams understand the organizational change it would take to migrate services online.

- I was able to teach product management practices to a team that previously did not know how to execute iteration (they had, at most, a theoretical understanding of it).

The team has now grown to probably twice the size of when I was there. - I’m also grateful that the Branch Banking Sector invited me to collaborate on the Branch future-proofing project (separate from my duties in the Digital Banking Division), as they recognized the benefit that qualitative research could bring.

One of the early pilot projects: Beginner Investing